Four home runs in a row . . .

Using last night's performance as an analogy for the stock market may be a bit of a reach but I'll try! And, since it's been a while since my last post, I'll be able to cover a lot of ground with it. Here goes:

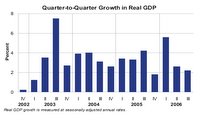

Home run #1: The Economy. Without a doubt, the economy's growth rate has slowed from last year's levels. However, the final revision of the 2006 was upward to 2.6% from 2.0% so we ended the year with a bit of momentum. We'll find out how much in just a few days as the Q1:2007 GDP preliminary report is out on the 27th. We're betting that it will be a "decent" report (say 2% give or take) albeit slowing somewhat given the rocky housing numbers and some unexpectedly poor weather - particularly in March. Remember that employment has remained strong and the unemployment rate is still low. So people are working and spending money and growing the economy.

Home run #2: Inflation/Interest Rates. Despite spikes in some commodity costs (have you bought any gas recently!) core inflation rates remain relatively subdued. While they may be a "smidge" above the Fed's comfort level, they are not spiraling out of control. We think that given somewhat slower GDP growth, continuing concerns over the subprime mortage market (and its impact on housing overall), the Fed can and will stand pat for some time to come. Stable interest rates are good for the economy and the stock market.

Home run #3: Corporate Earnings: Earnings reports are starting to flood in and, so far, companies are meeting forecasts at a rate surpassing most investors expectations. In fact, it appeared to us that last month, investors were bracing for some major disappointments. And while there have been some high profile misses, such as Yahoo! and AMD, strong reports from the likes of Google, Caterpillar, and even Intel have driven the market to new highs.

Home run #4: Buyouts galore: It seems that we start every day with at least one, multi-billion dollar buyout. While many of the buyers are private equity firms and hedge funds, we're also seeing some significant corporate buyout activity as well - witness today's by of Medimmune by AstraZeneca. The result of all this activity is a meaningful reduction in the amount of publicly traded stock. The simple law of supply and demand continues to provide uplift to our stock markets.

Bottom line? A month ago it looked like game over for the stock market. However, thanks to the four "home runs" listed above, we're once again making new highs in the Dow Jones Industrials. Time will tell if the bull market will keep its lead over the bears - but I wouldn't leave the park just yet.

Labels: bears, bulls, buyout, inflation, interest rates, stock market