Bonds Better Than Stocks in 3rd Quarter

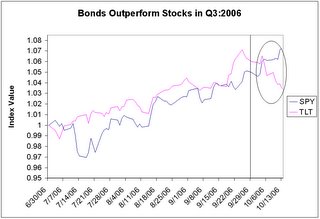

The third quarter was great for stocks with the S&P500 rising more than 5% between June 30, 2006, and September 30, 2006. But bonds did better! Look at the chart to the right. It compares the performance (price only) of the SPY, an S&P500 Index ETF and the TLT, a long bond ETF (click on the link for more info on ETF's). Long bonds rose in value over the period as interest rates fell, thanks to the end of Fed tightening, signs of a slowing economy, and lower energy prices. (Remember that there is an inverse relationship between interest rates and bond prices.)

Perhaps, the upward move in bonds (interest rates down) has had as much to do with a strong stock market as earnings reports, investor sentiment and the like. At the very least, falling interest rates (rising bonds) made stocks more competitive, particularly after their sharp correction from early May.

Please note the recent change in trend I have circled. The stock market continues to head higher while bonds have reversed trend and are falling in value. Interest rates have backed up a bit. While we don't believe this "trend-break" portends any serious problems for the stock market, it may raise the likelihood of a pause or short correction of the stock market's advance.

Since we're a bit bullish, we'd take advantage of any near term weakness in the market.

0 Comments:

Post a Comment

<< Home