Data Starting to Support Fed's Pause

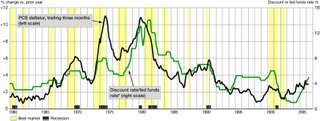

In just the last few days we have seen more data suggesting that the Fed's pause in hiking short term interest rates was both justified and likely to be sustained for more than a couple of months. In particular, today's announcement from the government's Bureau of Economic Analysis of solid growth in consumer spending and incomes and slightly better news on inflation. Take a look at this chart we found at Joe Ellis' Ahead of the Curve web site comparing the PCE deflator (lagged three months) versus the fed funds rate.  Importantly, it appears that the Fed has finally got the fed funds rate above inflation. We'd conclude that any stability in the inflation numbers should translate in to a less "hawkish" Fed.

Importantly, it appears that the Fed has finally got the fed funds rate above inflation. We'd conclude that any stability in the inflation numbers should translate in to a less "hawkish" Fed.

All in all,this is good news for the stock market in our view. It appears that the economy is growing (perhaps at a slower rate) and inflation/interest rates stabilizing. Stable interest rates will take some of the pressure off valuations and perhaps drive increased demand for stocks.

By the way, there are a lot of intersting charts and analysis at the Ahead of the Curve web site maintained by Joseph H. Ellis, a partner of Goldman Sachs who was ranked for eighteen consecutive years by Institutional Investor magazine as Wall Street’s #1 retail-industry analyst. The website is based on his recently published book Ahead of the Curve. It's certainly worth a look.

0 Comments:

Post a Comment

<< Home