This is the inaugural post on our new blog, "Perspectives on Investing". Here we will comment on the markets, investment topics, news events, respond to your questions and more.

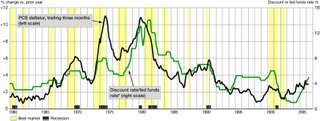

Last week, after seventeen straight quarter-point hikes, the Fed finally passed on raising short term interest rates at their regular meeting. Yet, the market was underwhelmed by the news. Why? The language in the Fed's press release left the door open to further hikes, perhaps as soon as the next meeting. It will depend on evidence that inflationary forces are indeed receding as Fed Chairman, Ben Bernanke expects.

From our perspective, that evidence is decidedly mixed so far. Recent employment data for example, shows job growth slowing but disturbingly, employment costs rising significantly faster than productivity. Employment costs are a key driver of core inflation, so the current situation is clearly of concern to us.

Today, we got favorable news on producer prices, with the core rate actually falling 0.1% last month. This good news has sent bond and stock markets upward as investors bet that the inflation news will continue to get better, that Ben Bernanke is right after all, and that the next direction for rates is down. Of course, there will be more news tomorrow and it's anyone's guess whether it will be good or bad, indicative of accelerating or decelerating inflation or an indicator of the Fed's next move.

Bottom line, we suspect that the market will continue to be volatile for the time being. Whether it's the violence in the Middle East, high oil prices, evidence of a slowing economy, concerns over corporate profits or uncertainty about the next Fed move, investors will find a reason to stay on the sidelines.

In our view, the correction that began last May will finally come to an end when some of these concerns are alleviated. We think a sustained stock market advance can occur once there is enough evidence that inflation is under control, that rates have at least stabilized and perhaps poised head lower. The risk to this scenario? Has Fed has already raised rates too much, the economy slows too much and corporate earnings slide? We'll just have to wait and see if this is the pause that refreshes.